Tầm nhìn

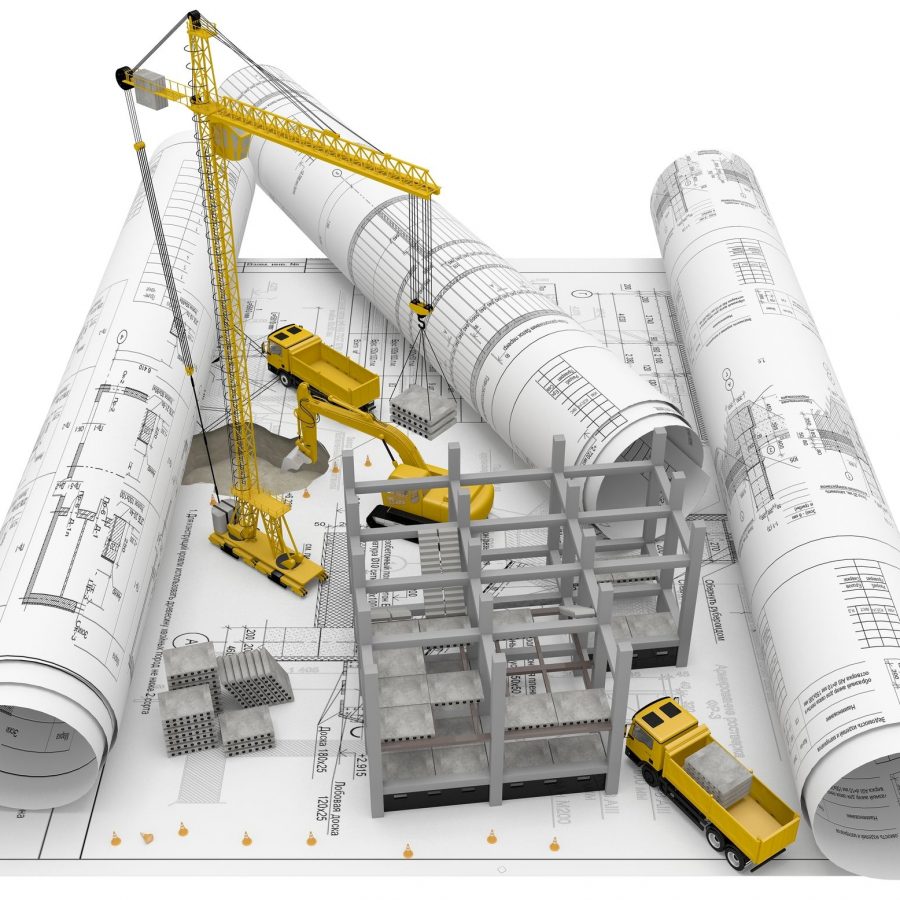

CNY đang từng bước thực hiện mục tiêu trở thành một trong những Công ty hàng đầu trong lĩnh vực cung cấp giải pháp. tư vấn, thiết kế & thi công xây lắp.

Sứ mệnh

Sứ mệnh của CNY là đem lại những giải pháp và dịch vụ xây dựng tốt nhất, chất lượng công trình và uy tín là ưu tiên hàng đầu chúng tôi cam kết mang tới cho khách hàng.